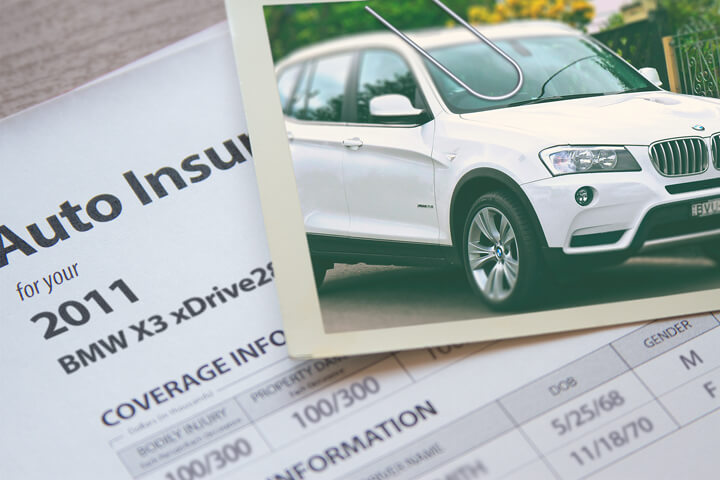

BMW X3 insurance image courtesy of QuoteInspector.com

Are you researching lower-priced BMW X3 insurance in Austin? Feel like you have high-priced BMW X3 insurance in Austin? Believe me when I say you are not the only one feeling buyer's remorse.

Are you researching lower-priced BMW X3 insurance in Austin? Feel like you have high-priced BMW X3 insurance in Austin? Believe me when I say you are not the only one feeling buyer's remorse.

Shocking but true, most drivers in Texas kept their policy with the same company for at least the last four years, and nearly half have never quoted auto insurance rates at all. With the average auto insurance premium being $1,847, American drivers could cut their rates by roughly 47% a year by just comparing rate quotes, but they don't understand how simple it is to compare rate quotes.

Many car insurance companies compete for your business, so it can be very hard to choose a provider to discover the definitive best rate on BMW X3 insurance in Austin.

Where can I get cheap Austin BMW X3 insurance?

All the larger insurance companies such as Allstate and Progressive allow you to get coverage price quotes on their websites. Comparing prices online for BMW X3 insurance in Austin can be done by anyone as you just type in your coverage preferences into a form. Behind the scenes, the quote system sends out for credit information and your driving record and returns a price based on many factors. Being able to quote online for BMW X3 insurance in Austin makes it easy to compare insurance prices and it's necessary to get many rate quotes if you want to get lower-cost prices.

If you want to compare rates now, compare rates from the companies below. If you have a policy now, it's recommended you copy the coverage information exactly as they are listed on your policy. Doing this assures you will have rate comparison quotes based on identical coverages.

The companies shown below offer price quotes in Texas. If several companies are displayed, we recommend you visit as many as you can in order to get a fair rate comparison.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X3 3.0I xDrive AWD 4-Dr | $228 | $424 | $382 | $22 | $114 | $1,170 | $98 |

| Get Your Own Custom Quote Go | |||||||

Data based on married male driver age 30, no speeding tickets, no at-fault accidents, $1,000 deductibles, and Texas minimum liability limits. Discounts applied include multi-vehicle, safe-driver, claim-free, homeowner, and multi-policy. Premium amounts do not factor in specific location information which can increase or decrease coverage rates considerably.

Physical damage deductibles: Should you raise them?

One of the more difficult decisions when buying auto insurance is how low should you set your deductibles. The comparison tables below can help you understand the differences in premium rates between low and high coverage deductibles. The first set of rates uses a $250 comprehensive and collision deductible and the second data table uses a $500 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X3 3.0I xDrive AWD 4-Dr | $370 | $672 | $382 | $22 | $114 | $1,585 | $132 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X3 3.0I xDrive AWD 4-Dr | $300 | $542 | $382 | $22 | $114 | $1,360 | $113 |

| Get Your Own Custom Quote Go | |||||||

Table data assumes married male driver age 30, no speeding tickets, no at-fault accidents, and Texas minimum liability limits. Discounts applied include homeowner, multi-vehicle, safe-driver, multi-policy, and claim-free. Estimates do not factor in specific garaging location which can lower or raise coverage rates significantly.

Using the premium rates above, we can conclude that using a $250 deductible costs an average of $19 more each month or $228 every year than requesting the higher $500 deductible. Due to the fact that you would have to pay $250 more if you turn in a claim with a $500 deductible as compared to a $250 deductible, if you tend to average at least 13 months between claims, you would save more money by going with a higher deductible.

How to calculate when to raise deductibles

| Average monthly premium for $250 deductibles: | $132 |

| Average monthly premium for $500 deductibles (subtract): | - $113 |

| Monthly savings from raising deductible: | $19 |

| Difference between deductibles ($500 - $250): | $250 |

| Divide difference by monthly savings: | $250 / $19 |

| Number of months required between physical damage coverage claims in order to save money by choosing the higher deductible | 13 months |

One important caveat is that a higher deductible results in having to pay to pay more out-of-pocket when you have to file a claim. That will force you to have enough money put aside in order to pay more to get your vehicle repaired.

BMW X3 insurance rates by gender

The example below shows the comparison of BMW X3 yearly insurance costs for male and female drivers. The data assumes no violations or claims, comp and collision included, $100 deductibles, drivers are single, and no discounts are applied to the premium.

Do you need full coverage?

The chart below illustrates the difference between BMW X3 insurance rates with full physical damage coverage and with liability coverage only. The data is based on no violations or accidents, $250 deductibles, single female driver, and no discounts are applied to the premium.

Should you be buying full coverage?

There is no exact formula to stop buying full coverage on your policy, but there is a guideline you can use. If the annual cost of comprehensive and collision coverage is more than around 10% of the vehicle's replacement cost less your deductible, the it may be a good time to stop paying for full coverage.

For example, let's assume your BMW X3 replacement cost is $7,000 and you have $1,000 physical damage deductibles. If your vehicle is totaled in an accident, the most your company would pay you is $6,000 after paying your policy deductible. If it's costing you more than $600 a year to have full coverage, then you may want to consider only buying liability coverage.

There are some cases where dropping full coverage is not financially feasible. If you still have a loan on your vehicle, you have to maintain full coverage as part of the loan conditions. Also, if you can't afford to buy a different vehicle if your current one is totaled, you should not buy liability only.

Insurance protects more than just your car

Despite the potentially high cost of BMW X3 insurance, buying insurance is required for several reasons.

First, the majority of states have minimum mandated liability insurance limits which means it is punishable by state law to not carry specific limits of liability protection in order to drive the car legally. In Texas these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

Second, if your car has a loan, almost all lenders will require you to carry insurance to ensure they get paid if you total the vehicle. If coverage lapses or is canceled, the bank may insure your BMW at a more expensive rate and force you to pay for it.

Third, insurance protects both your assets and your car. Insurance will pay for most medical and hospital costs incurred in an accident. Liability insurance, one of your policy coverages, will also pay attorney fees if you are named as a defendant in an auto accident. If your BMW gets damaged, your policy will cover the damage repairs after a deductible is paid.

The benefits of buying enough insurance greatly outweigh the cost, particularly if you ever have a claim. According to a recent study, the average American driver is overpaying more than $820 a year so you should quote and compare rates once a year at a minimum to ensure rates are competitive.

Companies offer many discounts on BMW X3 insurance in Austin

Auto insurance is expensive, but you may qualify for discounts that could drop your premiums quite a bit. A few discounts will be applied when you complete an application, but some must be manually applied prior to receiving the credit. If you are not receiving all the discounts you qualify for, you could be paying more than you need to.

- Discounts for Seat Belt Usage - Drivers who require all occupants to wear their seat belts could save 15% on medical payment and PIP coverage.

- Telematics Data Discounts - Drivers who elect to allow driving data submission to look at where and when they drive by using a telematic data system such as Progressive's Snapshot and State Farm's In-Drive may see discounts as long as the data is positive.

- Low Mileage - Keeping the miles down on your BMW could earn substantially lower auto insurance rates.

- Military Discounts - Being deployed in the military could mean lower auto insurance rates.

- Theft Prevention System - Anti-theft and alarm system equipped vehicles prevent vehicle theft and qualify for as much as a 10% discount.

- Homeowners Savings - Owning a home in Austin may earn you a small savings due to the fact that maintaining a home is proof that your finances are in order.

- Discount for Multiple Policies - If you can bundle your auto and homeowners insurance with one insurance company they may give you a discount of approximately 10% to 15%.

- Driver Training Discounts - Taking time to complete a defensive driving course could cut 5% off your bill if you qualify.

- Braking Control Discount - Cars and trucks with anti-lock braking systems can reduce accidents and earn discounts up to 10%.

Policy discounts save money, but some credits don't apply to all coverage premiums. The majority will only reduce individual premiums such as physical damage coverage or medical payments. So even though it sounds like you could get a free auto insurance policy, it's just not the way it works.

Popular auto insurance companies and some of the discounts are detailed below.

- State Farm policyholders can earn discounts including driver's education, defensive driving training, Drive Safe & Save, accident-free, and safe vehicle.

- GEICO includes discounts for air bags, emergency military deployment, daytime running lights, military active duty, and federal employee.

- Liberty Mutual offers discounts for multi-policy, safety features, hybrid vehicle, newly married, and newly retired.

- The Hartford offers premium reductions for air bag, bundle, anti-theft, vehicle fuel type, and good student.

- MetLife offers discounts including claim-free, good student, good driver, multi-policy, and accident-free.

- Progressive may include discounts for continuous coverage, online signing, online quote discount, multi-policy, homeowner, good student, and multi-vehicle.

If you need lower rates, check with each company to give you their best rates. All car insurance discounts may not apply in your state. To see a list of insurance companies that offer discounts in Texas, click this link.

You may require the services of a local insurance agent

Many drivers would prefer to have an agent's advice and often times that is recommended One of the best bonuses of comparing rates online is you can get cheap car insurance quotes and still choose a local agent.

Upon completion of this form (opens in new window), the coverage information is submitted to companies in Austin who will gladly provide quotes to get your business. There is no reason to leave your computer since price quotes are sent instantly to you. You can find the lowest rates without requiring a lot of work. In the event you want to compare prices from a specific insurance company, you would need to search and find their rate quote page to submit a rate quote request.

Picking the best provider requires more thought than just the price. Any agent in Austin should be forthright in answering these questions:

- Is auto insurance their primary focus in Austin?

- In the event of vehicle damage, can you pick the collision repair facility?

- What kind of financial rating does the company have?

- Does the agent help file claims?

- If you raise deductibles, how much can you save?

- Do they review policy coverages at every renewal?

- What is the agency's Better Business Bureau rating?

- How many companies do they write for?

How to choose the best car insurance agent in Austin

If you are searching for a reliable insurance agent, there are a couple of different agency structures and how they can write your policy. Austin agents can be categorized as either independent (non-exclusive) or exclusive.

Exclusive Agencies

Agents that choose to be exclusive can usually just insure with one company and some examples include American Family, State Farm, and Allstate. Exclusive agencies are unable to provide other company's prices so you might not find the best rates. Exclusive agents are well schooled on sales techniques which helps them sell on service rather than price.

The following is a list of exclusive agents in Austin who may provide you with price quote information.

Allstate Insurance: Fleming and Conway Agency

3435 Greystone Dr Ste 107 - Austin, TX 78731 - (512) 345-0005 - View Map

J B Ruebsahm - State Farm Insurance Agent

1901 W William Cannon Dr #131 - Austin, TX 78745 - (512) 444-1845 - View Map

Bridgette Hearne - State Farm Insurance Agent

3407 W Slaughter Ln b - Austin, TX 78748 - (512) 441-3704 - View Map

Independent Car Insurance Agents

Agents in the independent channel can sell policies from many different companies and that gives them the ability to insure through lots of different companies depending on which coverage is best. If prices rise, your agent can switch companies and you don't have to switch agencies. When searching for an agent, you will definitely want to get quotes from several independent insurance agents to have the best price comparison.

Listed below is a list of independent insurance agents in Austin that can give you price quotes.

EZ Insurance Agency - North

7600 N Lamar Blvd # E - Austin, TX 78752 - (512) 445-2700 - View Map

Lezam Insurance

4301 W. William Cannon Dr., Ste. B-120 - Austin, TX 78749 - (512) 263-4333 - View Map

Starr Insurance Agency

8801 Research Blvd #104 - Austin, TX 78758 - (512) 586-2000 - View Map

Will just any policy work for me?

When choosing proper insurance coverage, there really isn't a "best" method to buy coverage. Every insured's situation is different.

Here are some questions about coverages that might help in determining whether or not you would benefit from an agent's advice.

- Can I get by with minimal medical coverage if I have good health insurance?

- What does medical payments coverage do?

- Should I bundle my homeowners policy with my auto?

- Do I need special endorsements for business use of my vehicle?

- Is my teenager covered with friends in the car?

- Do I need replacement cost coverage?

- Why am I required to get a high-risk car insurance policy?

- Am I covered when driving in Canada or Mexico?

- Is my ex-spouse still covered by my policy?

If you're not sure about those questions but you know they apply to you, you may need to chat with an agent. To find an agent in your area, complete this form.

More quotes mean more car insurance savings

Consumers who switch companies do it for any number of reasons including questionable increases in premium, policy cancellation, policy non-renewal or an unsatisfactory settlement offer. Regardless of your reason for switching companies, finding the right car insurance provider is pretty simple and you could end up saving a buck or two.

When shopping online for car insurance, never reduce coverage to reduce premium. Too many times, drivers have reduced comprehensive coverage or liability limits only to find out that saving that couple of dollars actually costed them tens of thousands. The proper strategy is to purchase a proper amount of coverage at a price you can afford, but do not sacrifice coverage to save money.

We just showed you a lot of techniques to shop for BMW X3 insurance online. The key concept to understand is the more times you quote, the better your comparison will be. You may even discover the best price on car insurance is with the smaller companies.

Much more information about car insurance in Texas is located at these links:

- Vehicle Insurance in the U.S. (Wikipedia)

- Who Has Cheap Austin Auto Insurance Rates for Business Use? (FAQ)

- Who Has Cheap Austin Auto Insurance Quotes for Inexperienced Drivers? (FAQ)

- Who Has the Cheapest Car Insurance Quotes for a Mazda CX-7 in Austin? (FAQ)

- How Much are Auto Insurance Quotes for a Learners Permit in Austin? (FAQ)

- Who Has Affordable Car Insurance Rates for Police Officers in Austin? (FAQ)

- Medical Payments Coverage (Liberty Mutual)

- Event Data Recorders FAQ (iihs.org)

- Automakers compete to add autobraking (Insurance Institute for Highway Safety)