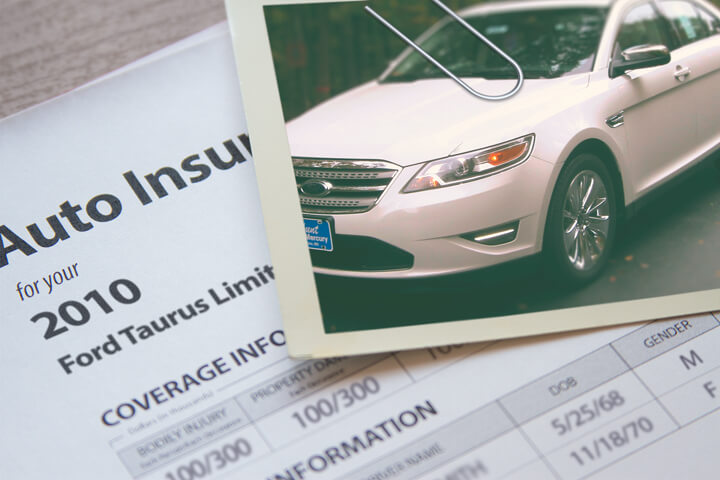

Ford Taurus insurance rates image courtesy of QuoteInspector.com

Are you intimidated by the sheer number of auto insurance companies available to you? You have such a vast assortment of companies available that it can easily turn into a ton of work to find better premium rates for Ford Taurus insurance in Austin. Everyone knows Austin is a wonderful place to live, but trying to pay high auto insurance rates makes it impossible to keep a tight budget.

Are you intimidated by the sheer number of auto insurance companies available to you? You have such a vast assortment of companies available that it can easily turn into a ton of work to find better premium rates for Ford Taurus insurance in Austin. Everyone knows Austin is a wonderful place to live, but trying to pay high auto insurance rates makes it impossible to keep a tight budget.

Shocking but true, over 70% of consumers kept their coverage with the same auto insurance company for four years or more, and just short of a majority have never compared rate quotes at all. Most drivers in Texas could save themselves almost 70% a year just by shopping around, but most just don't grasp how much savings they would realize if they switched to a more affordable policy.

It's a good habit to do price comparisons periodically since insurance prices change frequently. Even if you think you had the lowest rates on Ford Taurus insurance in Austin last year other companies may now be cheaper. Block out anything you think you know about auto insurance because I'm going to teach you the fastest way to lower your annual insurance bill.

Shopping for affordable insurance policy in Austin is actually quite simple. Nearly every person who compares rates for insurance will more than likely find lower prices. Although Texas consumers must comprehend the way companies determine prices and take advantage of how the system works.

The quickest method to get policy rate comparisons for Ford Taurus insurance in Austin is to realize most larger insurance companies allow for online access to compare their rates. All consumers are required to do is spend a couple of minutes providing details like what you do for a living, which vehicles you own, if the car is leased, and distance driven. That rating information is sent automatically to multiple different insurance companies and you will receive price estimates instantly.

To compare multiple company cheap Ford Taurus insurance rates now, click here and enter your zip code.

The companies in the list below are ready to provide price comparisons in Texas. If the list has multiple companies, it's a good idea that you get price quotes from several of them to find the most affordable auto insurance rates.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Taurus SE | $322 | $486 | $388 | $24 | $116 | $1,336 | $111 |

| Taurus SEL | $354 | $684 | $430 | $26 | $128 | $1,622 | $135 |

| Taurus SEL AWD | $470 | $698 | $500 | $30 | $150 | $1,848 | $154 |

| Taurus Limited | $176 | $306 | $358 | $22 | $108 | $970 | $81 |

| Taurus Limited AWD | $356 | $760 | $496 | $30 | $148 | $1,790 | $149 |

| Taurus SHO AWD | $326 | $624 | $462 | $28 | $138 | $1,578 | $132 |

| Get Your Own Custom Quote Go | |||||||

Price data assumes single male driver age 40, no speeding tickets, no at-fault accidents, $500 deductibles, and Texas minimum liability limits. Discounts applied include multi-policy, claim-free, safe-driver, homeowner, and multi-vehicle. Price information does not factor in vehicle garaging location which can revise rates significantly.

Driving violations and accidents

The information below illustrates how speeding tickets and at-fault accidents can raise Ford Taurus insurance rates for different age groups of insureds. The rates are based on a single female driver, comprehensive and collision coverage, $250 deductibles, and no discounts are applied to the premium.

Does it make sense to buy full coverage?

The diagram below illustrates the comparison of Ford Taurus insurance premiums with and without full coverage. Data assumes no claims or driving citations, $100 deductibles, married female driver, and no other discounts are factored in.

When to stop paying for full coverage

There isn't a written rule for eliminating comprehensive and collision coverage on your policy, but there is a general guideline. If the yearly cost for physical damage coverage is more than about 10% of the replacement cost of your vehicle minus the policy deductible, then it might be time to consider dropping full coverage.

For example, let's say your Ford Taurus book value is $7,000 and you have $1,000 full coverage deductibles. If your vehicle is severely damaged, the most your company would pay you is $6,000 after paying the physical damage deductible. If you are currently paying more than $600 annually for full coverage, then you might consider buying liability only.

There are a few cases where removing full coverage is not recommended. If you still owe a portion of the original loan, you have to carry full coverage in order to prevent your loan from defaulting. Also, if you can't afford to buy a different vehicle if your current one is totaled, you should not buy liability only.

Your situation helps dictate your coverage

When choosing proper insurance coverage, there is no one-size-fits-all type of policy. Everyone's situation is a little different so your insurance should reflect that Here are some questions about coverages that can help discover if your insurance needs could use an agent's help.

Here are some questions about coverages that can help discover if your insurance needs could use an agent's help.

- Is a new car covered when I drive it off the dealer lot?

- What is the rate difference between pleasure use and commuting?

- Am I covered by my employer's commercial auto policy when driving my personal car for business?

- Is there a penalty for late payment?

- How does medical payments coverage work?

- Should I put collision coverage on all my vehicles?

- Is my camper covered by my car insurance policy?

- Am I covered if I hit someone who is not insured?

- Is business property covered if stolen from my car?

- How long can I keep a teen driver on my policy?

If you don't know the answers to these questions but you know they apply to you, you may need to chat with a licensed insurance agent. To find an agent in your area, complete this form or you can go here for a list of companies in your area.

Are car insurance agents obsolete?

Some people just want to buy from a licensed agent and we recommend doing that An additional benefit of comparing rates online is that you can find lower rates and still buy from a local agent. Buying insurance from local agents is important particularly in Austin.

Once you complete this short form, your insurance data is sent to insurance agents in Austin who will give you quotes for your insurance coverage. There is no reason to do any legwork because prices are sent to you instantly. You can most likely find cheaper rates without requiring a lot of work. In the event you want to compare prices from a specific company, you would need to go to their quote page and give them your coverage information.

Once you complete this short form, your insurance data is sent to insurance agents in Austin who will give you quotes for your insurance coverage. There is no reason to do any legwork because prices are sent to you instantly. You can most likely find cheaper rates without requiring a lot of work. In the event you want to compare prices from a specific company, you would need to go to their quote page and give them your coverage information.

Listed below is a list of insurance companies in Austin that can give you price quotes for Ford Taurus insurance in Austin.

- Herman Askew - State Farm Insurance Agent

13201 Pond Springs Rd #105 - Austin, TX 78729 - (512) 250-5533 - View Map - State Farm: Dick Clay

3006 Bee Cave Rd Suite B170 - Austin, TX 78746 - (512) 328-2340 - View Map - Bennie Council - State Farm Insurance Agent

6448 US-290 f110 - Austin, TX 78723 - (512) 454-4524 - View Map - Greg Pearson - State Farm Insurance Agent

8705 Shoal Creek Blvd #102 - Austin, TX 78757 - (512) 451-0188 - View Map

Finding a good company requires more thought than just a low price. These questions are important to ask:

- Does the company have a local claim office in Austin?

- How long has their agency been open in Austin?

- Which members of your family are coverage by the policy?

- What companies can they write with?

- By raising physical damage deductibles, how much would you save?