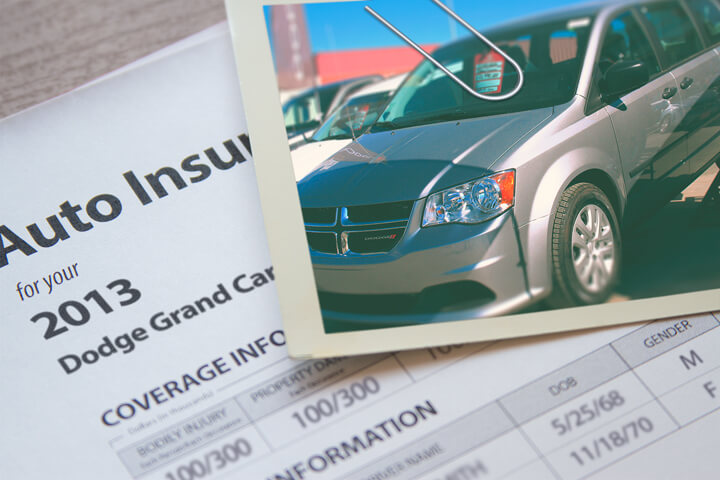

Dodge Grand Caravan insurance image courtesy of QuoteInspector.com

Want to know an easy way to compare cheaper car insurance rates in Austin, TX? Austin buyers have many options when searching for the best price on Dodge Grand Caravan insurance. They can either waste time calling around to get rate comparisons or utilize the internet to find the lowest rates.

Want to know an easy way to compare cheaper car insurance rates in Austin, TX? Austin buyers have many options when searching for the best price on Dodge Grand Caravan insurance. They can either waste time calling around to get rate comparisons or utilize the internet to find the lowest rates.

There are more efficient ways to compare car insurance rates so we're going to tell you the proper way to get price quotes for your Dodge and obtain the best price possible from both online companies and Austin agents.

Unimaginable but true, almost 70% of drivers have purchased from the same company for a minimum of four years, and nearly the majority have never compared rates with other companies. Austin drivers could save nearly 70% every year just by shopping around, but they just don't understand how easy it is to compare rates online.

You need to price shop coverage as often as possible because rates are constantly changing. Even if you got the best premium rates on Dodge Grand Caravan insurance in Austin a year ago a different company probably has better prices today. There is lot of inaccurate information about Grand Caravan insurance online but in this article, you're going to get some great ways to quit paying high car insurance rates in Austin.

The auto insurance companies shown below are our best choices to provide free quotes in Austin, TX. If the list has multiple companies, it's a good idea that you visit two to three different companies to get the best price comparison.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Grand Caravan CV | $282 | $460 | $496 | $30 | $148 | $1,416 | $118 |

| Grand Caravan SE | $298 | $448 | $392 | $24 | $118 | $1,280 | $107 |

| Grand Caravan Hero | $186 | $340 | $366 | $22 | $110 | $1,024 | $85 |

| Grand Caravan Crew | $256 | $412 | $358 | $22 | $108 | $1,156 | $96 |

| Grand Caravan SXT | $198 | $352 | $496 | $30 | $148 | $1,224 | $102 |

| Get Your Own Custom Quote Go | |||||||

Table data represents single female driver age 40, no speeding tickets, no at-fault accidents, $1,000 deductibles, and Texas minimum liability limits. Discounts applied include homeowner, claim-free, multi-policy, safe-driver, and multi-vehicle. Price estimates do not factor in zip code location which can impact coverage prices considerably.

How high should deductibles be?

The diagram below shows how different deductible levels and can affect Dodge Grand Caravan premium costs for different insured age categories. The prices are based on a married female driver, full physical damage coverage, and no discounts are factored in.

Lower rate quotes with discounts

Companies that sell car insurance don't always list every possible discount very clearly, so the next list breaks down both well-publicized as well as some of the hidden credits available to lower your premiums when you buy Austin car insurance online.

- Theft Deterrent - Cars, trucks, and SUVs with anti-theft systems can help prevent theft and will qualify for a discount on a Austin car insurance quote.

- Federal Government Employee - Simply working for the federal government could cut as much as 10% off with a few car insurance companies.

- Discount for Multiple Policies - If you have multiple policies with one insurance company you could save at least 10 to 15 percent or more.

- Good Driver Discounts - Drivers without accidents can pay as much as 50% less than drivers with accidents.

- Passive Restraint Discount - Vehicles equipped with air bags and/or automatic seat belt systems can qualify for discounts as much as 30%.

- Military Discounts - Having a deployed family member could mean lower prices.

While discounts sound great, it's important to understand that many deductions do not apply to all coverage premiums. A few only apply to the cost of specific coverages such as comprehensive or collision. So when it seems like it's possible to get free car insurance, it just doesn't work that way.

A list of companies and some of the discounts are detailed below.

- State Farm policyholders can earn discounts including driver's education, multiple policy, safe vehicle, passive restraint, good driver, and good student.

- Progressive has discounts for continuous coverage, multi-vehicle, online quote discount, homeowner, good student, online signing, and multi-policy.

- Travelers may include discounts for save driver, home ownership, hybrid/electric vehicle, student away at school, and continuous insurance.

- American Family includes discounts for good student, mySafetyValet, good driver, air bags, and multi-vehicle.

- Liberty Mutual discounts include multi-policy, preferred payment discount, multi-car, new move discount, safety features, and new graduate.

If you need cheaper Austin car insurance quotes, ask all companies you are considering to apply every possible discount. Some discounts listed above might not be available to policyholders in your area. To see a list of companies with discount rates in Texas, click here.

What Determines Dodge Grand Caravan Insurance Rates?

Many things are considered when you get your auto insurance bill. A few of the factors are predictable such as your driving history, but other criteria are not as apparent like where you live and annual miles driven.

- Additional coverages that may be costing you - There are quite a few additional coverages that can add up when buying insurance. Insurance for vanishing deductibles, accident forgiveness, and additional equipment coverage may not be needed and are just wasting money. The coverages may be enticing initially, but now you might not need them so consider taking them off your policy.

- Occupation stress can make you pay more - Did you know your insurance rates can be affected by your occupation? Jobs such as military generals, executives and stock brokers generally have the highest average rates due to intense work-related stress and long work days. Conversely, jobs like farmers, engineers and homemakers receive lower rates.

- Single drivers take more risk - Being married may cut your premiums compared to being single. Marriage means you're more mature it has been statistically shown that drivers who are married are more cautious.

- Cheaper insurance rates using GPS tracking and theft deterrents - Purchasing a vehicle that has an advanced theft prevention system can save you a little every year. Anti-theft features like OnStar found on GM vehicles, advanced tracking like LoJack, and vehicle immobilization systems help track and prevent your vehicle from being stolen.

- Loss statistics for a Dodge Grand Caravan - Insurers use past loss statistics for each vehicle in order to profitably underwrite each model. Models that are shown to have higher claim amounts or frequency will have a higher premium rate.

The next table illustrates the insurance loss data for Dodge Grand Caravan vehicles. For each type of coverage, the statistical loss for all vehicles, without regard to make or model, is equal to 100. Numbers under 100 indicate better than average losses, while numbers that are greater than 100 indicate a higher chance of having a claim or tendency to have larger claims.Dodge Grand Caravan Insurance Claim Statistics

Vehicle Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Dodge Grand Caravan 79 104 81 108 108 107 Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

When to contact an insurance agent

A lot of people just want to sit down with an agent and that is OK! Insurance agents are highly skilled in risk management and give you someone to call. The best thing about comparing rate quotes online is the fact that drivers can get cheap auto insurance quotes and still choose a local agent. And supporting neighborhood agents is still important in Austin.

To help locate an agent, after submitting this short form, the coverage information is instantly submitted to local insurance agents in Austin who can give free rate quotes for your business. It's much easier because you don't need to do any legwork as quotes are delivered to you. In the event you want to compare rates from a particular provider, just search and find their rate quote page and fill out the quote form the provide.

To help locate an agent, after submitting this short form, the coverage information is instantly submitted to local insurance agents in Austin who can give free rate quotes for your business. It's much easier because you don't need to do any legwork as quotes are delivered to you. In the event you want to compare rates from a particular provider, just search and find their rate quote page and fill out the quote form the provide.

The different types of auto insurance agents

If you are searching for a local Austin insurance agency, it's important to understand the different types of agencies and how they differ in how they quote coverages. Auto insurance agencies are classified as either independent or exclusive. Either type can sell affordable auto insurance policies, but it's a good idea to understand the subtle differences since it can impact which type of agent you select.

Independent Insurance Agents

Independent agencies do not write with just one company so they can insure your vehicles with a variety of different insurance companies and possibly get better coverage at lower prices. To transfer your coverage to a different company, the business is moved internally and that require little work on your part. When comparing auto insurance prices, we highly recommend that you get several quotes from several independent insurance agents so that you have a good selection of quotes to compare. They often place coverage with lesser-known insurance companies that many times have cheaper rates.

Shown below is a short list of independent agents in Austin that may be able to provide free auto insurance rate quotes.

- Lezam Insurance

4301 W. William Cannon Dr., Ste. B-120 - Austin, TX 78749 - (512) 263-4333 - View Map - EZ Insurance Agency

343 S Congress Ave - Austin, TX 78704 - (512) 444-3279 - View Map - EZ Insurance Agency - North

7600 N Lamar Blvd # E - Austin, TX 78752 - (512) 445-2700 - View Map

Exclusive Auto Insurance Agents

Agents of this type can only provide pricing for a single company such as State Farm or Allstate. These agents are unable to provide prices from multiple companies so they have no alternatives for high prices. They receive extensive training on their products and sales techniques and that can be a competitive advantage. Some insured continue to use the same exclusive agent mostly because of the prominent brand name rather than low price.

Below are Austin exclusive insurance agents that can give you price quote information.

- Allstate Insurance: Richard Harper

1807 W Slaughter Ln Ste 400 - Austin, TX 78748 - (512) 292-7410 - View Map - State Farm: Dick Clay

3006 Bee Cave Rd Suite B170 - Austin, TX 78746 - (512) 328-2340 - View Map - Karen Hall - State Farm Insurance Agent

7004 Bee Cave Rd #3 - Austin, TX 78746 - (512) 327-6200 - View Map

Picking an insurance agency requires more thought than just the price. These are valid questions to ask:

- What insurance companies do they work with in Austin?

- How are claims handled?

- Which insurance company do they prefer to write with?

- Who is covered by the car insurance policy?

- If they are an independent agency in Austin, which companies do they recommend?

- Do they offer accident forgiveness?

- Is the agent properly licensed in Texas?

- Where would glass claims be handled in Austin?

Do I just need basic coverages?

When it comes to buying coverage for your vehicles, there really is not a perfect coverage plan. Everyone's situation is a little different so your insurance needs to address that. These are some specific questions might point out whether your personal situation might need an agent's assistance.

These are some specific questions might point out whether your personal situation might need an agent's assistance.

- Do I have newly-aquired coverage?

- Am I covered when driving someone else's vehicle?

- Am I covered if hit by an uninsured driver?

- Do I have coverage if I rent a car in Mexico?

- Do I need replacement cost coverage on my Dodge Grand Caravan?

- Will filing a claim cost me more?

- How do I file an SR-22 for a DUI in Texas?

- Is my nanny covered when transporting my kids?

- I have health insurance so do I need medical payments coverage?

- Is my vehicle covered by my employer's policy when using it for work?

If you can't answer these questions, you may need to chat with a licensed insurance agent. To find lower rates from a local agent, simply complete this short form or you can go here for a list of companies in your area. It is quick, free and can provide invaluable advice.

Don't listen to company ads

Consumers in Texas constantly see and hear ads that promise big savings by Progressive, Allstate and GEICO. They all seem to make the promise that drivers can save some big amount just by switching to them.

Is it even possible that every company can give you a better price on Dodge Grand Caravan insurance in Austin?

Most companies quote the lowest rates for the type of driver that will not have excessive claims. An example of a desirable risk may be between the ages of 30 and 50, has no prior claims, and has excellent credit. Any new insured who meets those qualifications will get very good Austin rates and will save if they switch.

Consumers who may not quite match the requirements will be quoted a higher premium and this results in business going elsewhere. The wording the ads use say "people who switch" not "all people who quote" can save as much as they claim. That's the way companies can truthfully make the claims of big savings.

This illustrates why it is so important to get price quotes at each policy renewal. It's impossible to know which company will give you lower premium rates than your current company.

Don't give up on cheap coverage

You just learned a lot of ways to shop for Dodge Grand Caravan insurance online. It's most important to understand that the more price quotes you have, the more likely it is that you will get a better rate. Drivers may even discover the most savings is with the smaller companies. These companies may have significantly lower rates on certain market segments as compared to the big name companies such as Allstate and Progressive.

Cost effective Dodge Grand Caravan insurance is definitely available both online in addition to many Austin insurance agents, so you should compare both to have the best rate selection. Some insurance companies may not have rate quotes online and usually these smaller providers only sell coverage through independent agents.

For more information, feel free to visit the resources below:

- Protecting Teens from Drunk Driving (Insurance Information Institute)

- Who Has Affordable Austin Car Insurance Quotes for High Risk Drivers? (FAQ)

- Medical Payments Coverage (Liberty Mutual)

- Auto Insurance Learning Center (State Farm)