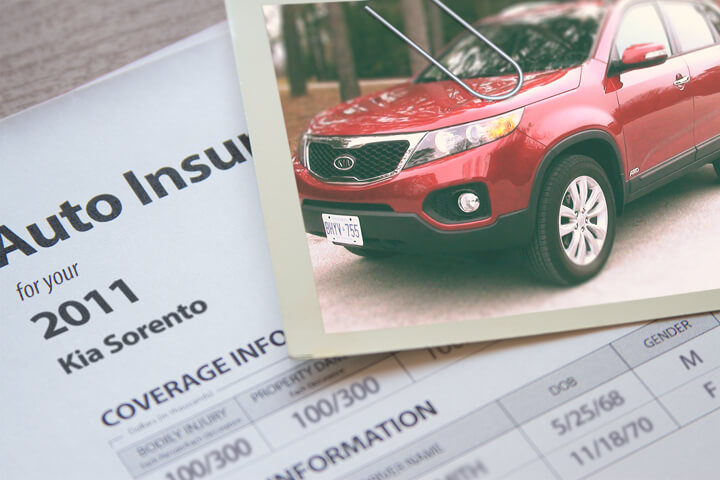

Kia Sorento insurance image courtesy of QuoteInspector.com

I can't think of anyone who likes paying for car insurance, especially when they are paying too much.

Statistics show that a large majority of car insurance policyholders have remained with the same car insurance company for four years or more, and about 40% of consumers have never compared car insurance rates at all. Austin insurance shoppers could save almost 70% a year just by comparing rates, but they mistakenly think it's difficult to shop their coverage around.

Statistics show that a large majority of car insurance policyholders have remained with the same car insurance company for four years or more, and about 40% of consumers have never compared car insurance rates at all. Austin insurance shoppers could save almost 70% a year just by comparing rates, but they mistakenly think it's difficult to shop their coverage around.

Multiple auto insurance companies compete to insure your vehicles, so it can be very hard to choose a insurance company and get the best coverage at the lowest cost out there.

If you have auto insurance now, you will be able to save money using the tips covered below. Choosing the best insurance company for you in Austin is actually not that difficult if you follow our advice. But Texas consumers must comprehend the way companies calculate your auto insurance rates because it can help you find the best coverage.

All the larger car insurance companies like Allstate, GEICO and Progressive give coverage prices directly from their websites. Comparing prices online for Kia Sorento insurance in Austin doesn't take much effort as you just type in your coverage information into the quote form. After the form is submitted, their rating system automatically orders information on your driving record and credit history and gives you a price quote based on these and other factors. Getting online quotes for Kia Sorento insurance in Austin makes it easy to compare insurance prices and it's absolutely necessary to do this in order to get the cheapest possible prices on car insurance.

To save time and find out how much you can save on car insurance, consider comparing rates from the companies shown below. To compare your current rates, we recommend you complete the form with deductibles and limits identical to your current policy. This helps ensure you will have an apples-to-apples comparison based on similar coverages.

The auto insurance companies shown below are our best choices to provide quotes in Texas. If multiple companies are listed, we suggest you visit several of them in order to find the most competitive rates.

Lower-cost Austin insurance rates with discounts

Some companies don't always list every discount in a way that's easy to find, so the below list has some of the more common as well as the least known credits available to bring down your rates. If you do not check that you are getting every discount possible, you could be getting lower rates.

- Anti-lock Brake Discount - Cars and trucks with ABS braking systems or traction control can stop better under adverse conditions and will save you 10% or more on Sorento insurance in Austin.

- Air Bag Discount - Cars that have air bags could see savings up to 30%.

- Use Seat Belts - Using a seat belt and requiring all passengers to use their safety belts can save 10% or more off the PIP or medical payment premium.

- Multi-Vehicle Discounts - Buying insurance for multiple vehicles with one company may reduce the rate for each vehicle.

- Include Life Insurance and Save - Select insurance carriers reward you with a break if you buy some life insurance in addition to your auto policy.

Remember that many deductions do not apply to the entire policy premium. Most only cut the price of certain insurance coverages like medical payments or collision. So even though you would think all the discounts add up to a free policy, you aren't that lucky.

For a list of providers with significant discounts in Texas, click here.

Best reasons to buy insurance in Texas

Despite the high cost, insurance is most likely required but also gives you several important benefits.

- Almost all states have compulsory liability insurance requirements which means you are required to buy a specific level of liability if you want to drive legally. In Texas these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If your Sorento has a lien holder, it's most likely the lender will make it mandatory that you buy full coverage to protect their interest in the vehicle. If the policy lapses, the bank or lender will purchase a policy for your Kia at a much higher premium rate and force you to pay much more than you were paying before.

- Insurance safeguards not only your car but also your assets. Insurance will pay for medical bills for you, any passengers, and anyone injured in an accident. Liability coverage, the one required by state law, will also pay for a defense attorney in the event you are sued. If your Kia gets damaged, your insurance policy will pay to restore your vehicle to like-new condition.

The benefits of insuring your car are without a doubt worth the cost, especially with large liability claims. The average driver in Texas is currently overpaying as much as $750 every year so you should quote your policy with other companies once a year at a minimum to ensure rates are competitive.

When should I contact a local insurance agent?

Some consumers still prefer to sit down and talk to an agent and that is recommended in a lot of cases One of the benefits of getting free rate quotes online is that you can obtain cheap auto insurance rates and also buy local. And buying from local insurance agencies is important particularly in Austin.

To help locate an agent, after submitting this short form, the quote information is transmitted to participating agents in Austin who want to provide quotes for your auto insurance coverage. You don't have to search for an agent due to the fact that quote results will go to the email address you provide. Get lower rates without a big time investment. If for some reason you want to get a rate quote from a specific auto insurance provider, don't hesitate to jump over to their website and submit a quote form there.

To help locate an agent, after submitting this short form, the quote information is transmitted to participating agents in Austin who want to provide quotes for your auto insurance coverage. You don't have to search for an agent due to the fact that quote results will go to the email address you provide. Get lower rates without a big time investment. If for some reason you want to get a rate quote from a specific auto insurance provider, don't hesitate to jump over to their website and submit a quote form there.

Listed below are agents in Austin that are able to give rate quotes for Kia Sorento insurance in Austin.

Herman Askew - State Farm Insurance Agent

13201 Pond Springs Rd #105 - Austin, TX 78729 - (512) 250-5533 - View Map

Independent Insurance Agents

1115 San Jacinto Blvd - Austin, TX 78701 - (512) 476-6281 - View Map

Allstate Insurance: Homero Escobar

730 W Stassney Ln Ste 230 - Austin, TX 78745 - (512) 443-9598 - View Map

Watkins Insurance Group

3834 Spicewood Springs Rd - Austin, TX 78759 - (512) 452-8877 - View Map

Picking the best company shouldn't rely on just a cheap price. The answers to these questions are important, too.

- Do they offer accident forgiveness?

- Will they make sure you get an adequate claim settlement?

- What are the financial ratings for the companies they represent?

- Do they carry Errors and Omissions coverage?

- Are aftermarket or OEM parts used to repair vehicles?